Moore Stephens North America is comprised of over 40 member firms that provide key services across a wide variety of industries and niches. This month’s “Moore Together” is a collaboration between two Chief Operation Officers: Cody Page with Peterson Sullivan and Kimpa Moss with Lurie LLP.

Moore Stephens North America is comprised of over 40 member firms that provide key services across a wide variety of industries and niches. This month’s “Moore Together” is a collaboration between two Chief Operation Officers: Cody Page with Peterson Sullivan and Kimpa Moss with Lurie LLP.

With tech firms such as Uber and Amazon clearly winning the race against their longstanding rivals, many industries are left wondering whether tech startups will dramatically change how their industries do business.

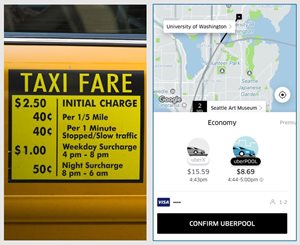

Public accounting is no different. According to industry thought leaders, we are near the top of the list for disruption, making it nearly certain that technology will fundamentally change the way we do business to stay relevant – and soon. The magnitude of that change is, to say the least, substantial. Is public accounting going to be the taxi industry, or can we be Uber? Will we let our current success and models keep us from adapting to the new world?

While industry conferences have been addressing why we need to change, it was refreshing to hear the initial steps we can take to get started at the

MSNA Fall Conference. Many of the industry experts have made the What and Why very clear: the Big 4 and other large national firms are investing millions of dollars in AI, automation, and blockchain. We expect downward fee pressures as more of the traditional audit and tax compliance work becomes automated – and the drive to commodity status will be complete. If there is any indication of what's to come, we can look at the healthcare industry, where primary care doctor visits are being done via telemedicine for $35 each.

So what are our next steps? We need to move quickly, and many MSNA firms have the talent - and the capital - to make that happen. With many firms drafting their 2018 strategic plans, how do business and digital transformation fit in? If you haven't started to figure out your plan and specifically HOW to begin your firm's transformation, Peterson Sullivan and Lurie have put together some ideas to get you started.

- Go-to-market with new advisory service offerings – The industry experts agree that a diversified service and revenue portfolio is required to be future‑relevant. It's great to hear many MSNA firms (especially the larger ones) have started to diversify service offerings beyond compliance. Many firms already have launched IT Assurance, Wealth Advisory, and Outsourced CFO services, with other services like HR and IT Strategy consulting in the pipeline. So, where to start?

- It may sound obvious, but have you surveyed your clients to see what other potential services they would want? The AICPA will soon provide webinars on launching IT Risk programs and rebooting your bookkeeping work into a higher value Outsourced Accounting/CFO service line.

- Do you have a framework to be able to go to market with new service lines? The most important first step is to identify the right leader – someone who has a growth mindset, high execution skills, and a passion for the services & clients who will be served.

Other key elements include:

- Getting the stakeholders on the same page

- Developing the menu of services you plan to offer and how to price them

- Determining metrics to measure success identifying the tools that will be required

- Identifying existing staff interest

- Considering what cross selling opportunities exist

- Crafting a marketing and communications plan and calendar

Governance is key. While many CPA firms don't have an entrepreneurial mindset, the experts at the management consulting firms agree - allow your business unit to operate in a startup-like mindset within your firm, free from the old mindsets, which tend to discourage failing forward.

- Lean & Value chain automation – Systemize the predictable so you can humanize the exceptional. When you buy a Mercedes Benz, you see a car engineered with a focus on the driving experience. What you don't see is how a nearly fully automated assembly line built the car. Your processes need to be consistent (remove or reduce personal preferences), your value stream needs to be mapped out, and waste (any steps that don’t add value in the process) has to be eliminated. With your processes mapped out, and non-value-adding steps removed, you're ready to automate. Remember that it's tough or impossible to apply automation when you have managers and partners who can't agree on how to deliver a tax return to a client. Look at your value chain and choose technology solutions that can remove steps in your processes. Companies like Boomer Consulting have resources that can help and both of our Firms have engaged them for projects. If you've struggled to realize the investment of your paperless initiatives, it's likely you're replicating your non-lean, inconsistent, paper process that's been around for many years.

Cloud – CPAs have maintained an eco-system of applications, either on premise or in the cloud, separate from clients, so we rely on shipping data back and forth. That is inefficient. Next-generation applications extend your technology "stack" to your clients, which allow you to collaborate on data real-time. If you want to see this in action, look at how firms using QuickBooks Online (cloud GL), Bill.com (AP/AR), and Concur or Tallie (expense management) have been able to help transform low-fee bookkeeping work into fully outsourced managed services. In 2017, is there an excuse not to have 100% of your data in the cloud? Explore solutions providers that can get you there.

Cloud – CPAs have maintained an eco-system of applications, either on premise or in the cloud, separate from clients, so we rely on shipping data back and forth. That is inefficient. Next-generation applications extend your technology "stack" to your clients, which allow you to collaborate on data real-time. If you want to see this in action, look at how firms using QuickBooks Online (cloud GL), Bill.com (AP/AR), and Concur or Tallie (expense management) have been able to help transform low-fee bookkeeping work into fully outsourced managed services. In 2017, is there an excuse not to have 100% of your data in the cloud? Explore solutions providers that can get you there.- Pricing – At the MSNA conference, Ron Baker reminded us that our billable hour business model is like a taxi cab meter – not the fixed fee quote you get before you decide to order an Uber. Up-front pricing on all engagements changes the conversation and gets everyone on the same page without limiting your upside when dealing with true value-added projects. A great place to get started is a client service team planning meeting with both existing and new clients. Take the time to train your audit/tax managers to be better project managers - build strong scoping into engagement letters, better identify change orders mid-engagement, and identify managed-service pricing.

- Digital client experience – Promote an experience that will make millennials want to do business with you. How many any of them want paper organizers? As we now interact with our banks mainly via apps or browsers, we need a solution that puts the digital experience first. What can you do now? If you haven't looked at tools like SafeSend Returns by cPaperless or TaxCaddy from SurePrep, you owe it to your clients and your firm to evaluate efficiencies in tax return, engagement letter, and organizer delivery efficiency. Like online banking apps, these tools extend your systems to your client and allow you to collaborate on one platform. They are also a big win in the automation category.

- Reskilling – At our respective firms, our staff and prospective staff are reading the same doom-and-gloom industry publications about the death of compliance work. They care about working for a firm that can keep them and their skills relevant. What's your talent strategy beyond recruiting and retention and training for compliance work? It's going to take something beyond providing "how to be a consultant" training. Transplanting people into your new service lines will give them the highest chance for success.

- Expanding services in existing service lines – The larger MSNA firms have done a tremendous job pivoting offerings within their audit and tax departments: International Tax, R&D Tax credits, SALT, etc. - but there's likely more than can be done.

MSNA is an association of firms working together to help one another become cutting-edge. Will yours become the Uber, or the Yellow Cab of CPA firms? If management can't agree to innovate, your firm may face a rapid demise at its own hands because “change is gradual – until it isn’t” (Malcolm Gladwell).

To learn more, check out these resources from the national management consulting firms that offer this as a service.

To learn more about business transformation, please contact

Cody Page with

Peterson Sullivan or

Kimpa Moss with

Lurie LLP.

We’re great alone, but we’re “Moore Together!” If you would like to collaborate with other members, or if you have a topic you would like to address, please contact Laura Ponath.